When it comes to clients under age 30, it is often the case that the generic income chart shows income level that should receive the premium tax credit subsidy. In many cases they do not receive subsidy--even with income in the 300-400% range. This creates some confusion and an understanding of the "benchmark" used in this calculation.

The benchmark plan is the second lowest cost Silver plan in any rating area. Subsidy eligibility is strictly based upon the premium cost of the benchmark plan.

This is from a recent case...

Single Age 27, Los Angeles, MAGI (modified adjusted gross income) $34,000. This is generally found on line 37 form 1040.

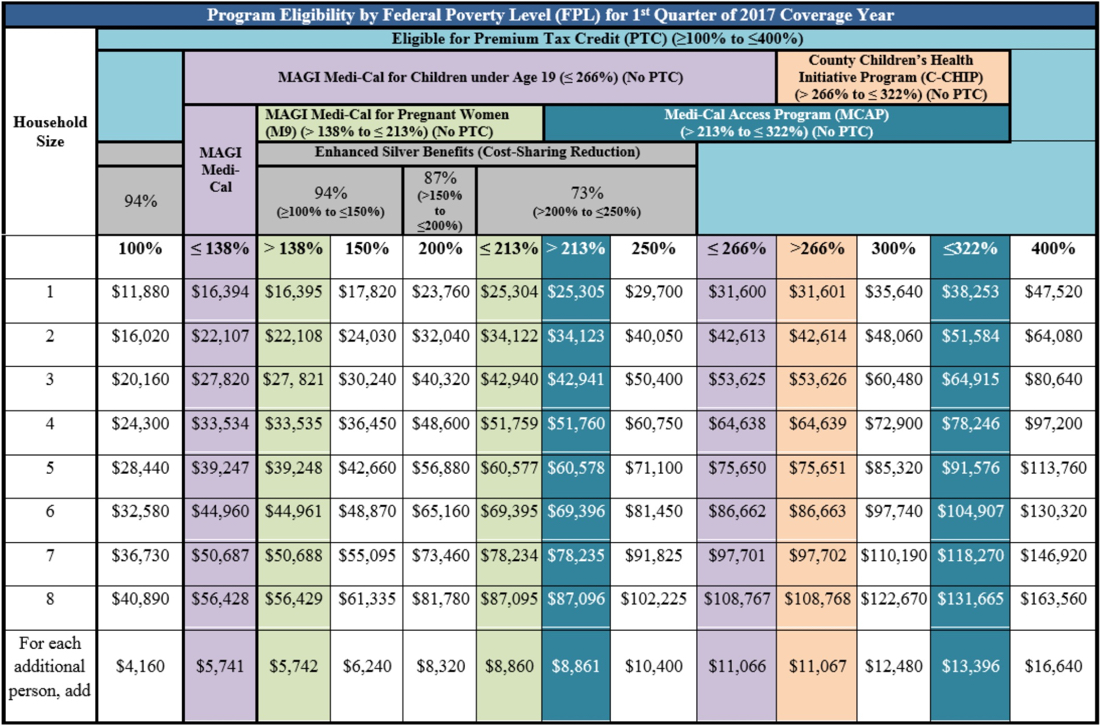

According to the income chart (see below), that income should qualify for the premium tax credit subsidy. In this case however, due to the low premium of the benchmark plan in the LA rating area, no subsidy is allowed.

Premium tax credit subsidy is designed to reduce the total annual premium for health insurance to not more than 9.69% of the MAGI. This is considered "affordable" by the government and indexes every year.

In this case, the benchmark plan premium is $261 per month (LA Care HMO). Calculating out the benchmark yields the following:

$261 X 12 = 3,132.00 (annual benchmark plan premium)

$3,132.00 / ,.0969 (9.69%) = $32,321.98 (9.69% affordable income maximum)

So, in this case, even though the income for this individual falls into a premium tax credit subsidy range according to the Covered CA income chart, because the premium for the benchmark second lowest cost Silver plan is so low, any MAGI at or greater than $32,321.98 would not receive subsidy.

Dave

www.davefluker.com

Covered CA Benchmark And Premium Tax Credit Subsidy Limit

May 01, 2017

Health Care Without Harm

Mahmood Ali

July 17, 2021

Health Care Without Harm Personal health depends partially on the active, passive, a…

- July2

- March6

- February42

- January51

- December63

- November35

- October14

- September17

- August10

- July3

- June7

- May19

- April14

- March31

- February19

- January6

- December8

- November10

- October11

- September7

- August8

- July6

- June5

- May11

- April13

- March11

- February14

- January12

- December14

- November17

- October18

- September17

- August17

- July11

- June12

- May12

- April8

- March14

- February12

- January9

- December8

- November1

- October3

- September5

- August6

- July10

- June1

- May5

- April6

- March7

- February8

- January10

- December4

- November13

- October10

- September4

- August7

- July6

- June2

- May5

- April4

- March6

- February7

- January3

- August3

- July18

- June4

- December2

- November5

- October7

- September3

- August4

- July11

- June29

- May16

- April18

- March24

- February26

Main Menu

Breaking

Recent In Internet

Recent Post

Recent

Technology

Recent Posts

3/Softwares/post-list

Popular Posts

Health Care and Poison Control

June 29, 2015

Health Care and Rodents

September 12, 2014

Rumi Neely & Miu Miu

June 02, 2010

Categories

- @docburnout2015 2

- #24 1

- #30daysofLOL 4

- #adultingwithdiabetes 3

- #bgnow 2

- #cwdffl2017 2

- #dam 1

- #dblogweek 7

- #DBMineSummit 1

- #Diabetesaccessmatters 4

- #doc 5

- #doc #dsma 1

- #docburnout2015 1

- #dsma 6

- #hearingdiabetesvoices 2

- #insulin4all 1

- #IWishPeopleKnewThat Diabetes 6

- #IWishPeopleKnewThatDiabetes 5

- #IwishPeopleKnewThatDiabetes means "adulting with diabetes" 1

- #IWishPeopleKnewThatDiabetesDay 4

- #laceup4diabetes 1

- #marchforhealth 2

- #medtronicDAF 1

- #NDAM 3

- #READTHEBILL 6

- #sparearose 4

- #t1dlookslikeme 3

- #tbt 2

- #who 1

- $15 1

- $20 1

- $25 2

- $400 billion 1

- $40k 1

- $5 million 1

- 1 in a million 1

- 100000 1

- 1095-A 1

- 2 year 1

- 2014 12

- 2015 3

- 2016 2

- 2017 9

- 2018 13

- 2019 1

- 23% 1

- 24 1

- 25% 1

- 3 months 2

- 37% 1

- 4healthyca 1

- 51-100 1

- 6 months 1

- 65 1

- 65+ 2

- 7% 1

- 73 1

- 87 1

- 90 days 3

- 900 billion 1

- 94 1

- a affordable auto insurance 1

- a1c 1

- aa insurance auto auction 1

- aa insurance auto auctions 1

- Aaron Kassover 1

- ABC News 1

- ACA 38

- access 1

- accidents happen 1

- acquisition 4

- across state lines 1

- advanced 1

- advantage 1

- Aetna 5

- affordable 2

- affordable auto insurance 1

- affordable car insurance 1

- Agent Methods 1

- agent number 1

- agents 4

- agreement 2

- aha 1

- AHCA 8

- Aiden Hill 1

- Alaska 1

- Ala�a 1

- alert 1

- alternatives 1

- am best insurance ratings 1

- American Diabetes Association 1

- american girl 1

- American Health Care Act 10

- Anthem 30

- antitrust 1

- appeal 2

- Appetizers 4

- Applications 1

- Approved 2

- APTC 1

- Aquisition 1

- arizona 1

- article 1

- Asian 1

- Assembly 2

- Assets 1

- assisters 1

- association 1

- Assurant 2

- Assurant Health 3

- Atkins 8

- Atlas Travel 1

- attack 2

- authorized 1

- auto insurance 3

- auto insurance companies 4

- auto insurance company 1

- auto insurance comparisons 1

- auto insurance quote 1

- auto insurance quote comparison 2

- auto insurance quote comparisons 1

- auto insurance quote online 1

- auto insurance quotes 1

- auto insurance quotes comparison 1

- auto insurance quotes online 2

- auto insurance rates 2

- auto insurance rates comparison 1

- auto insurance review 1

- auto insurance reviews 1

- auto owners insurance reviews 1

- availability 1

- average auto insurance rates 1

- award 1

- bailing 1

- Baked 23

- balcony 2

- balmain 2

- balmain style 1

- bank 1

- Barack Obama 3

- basal rates 1

- BCBS 1

- Beef 6

- beige 1

- benchmark 2

- benchmark plan 2

- best auto insurance companies 1

- best auto insurance company 1

- best auto insurance rates 1

- Bill 5

- Bill Cassidy 3

- Bill Whittle 3

- billing 2

- Bitch Low 4

- block 1

- blocked 1

- Blog 2

- blogaversary 2

- blogger 3

- blogging 1

- blood sugar 10

- Blood Sugar Blahs 8

- Blood Sugar Nirvana 3

- Blood Sugar Nirvana - NOT 1

- blood thinners 1

- blue 1

- blue candles 1

- Blue Cross 27

- Blue Shield 17

- BlueCard PPO 1

- bolus 1

- bolus worthy 1

- bolusing 1

- boxes 1

- Breach 3

- Breads 4

- Breakfast & Brunch 1

- brokers 1

- Bronze 1

- Brownies 2

- budget 4

- Buffalo 1

- business 1

- buyout 3

- CA Senate Bill 1

- Cakes 11

- Calderon 1

- California 90

- california auto insurance laws 1

- california auto insurance quotes 1

- california auto insurance requirements 1

- California Birthday Rule 2

- california low cost auto insurance 1

- california state auto insurance 1

- Californians for a Healthy California Act 7

- call in 1

- cancellation 4

- Cancelled 4

- cancer 1

- cap 1

- car insurance companies 1

- car insurance florida 1

- car insurance in florida 1

- car insurance quote comparison 1

- car insurance quotes 3

- car insurance quotes compare 1

- car insurance quotes comparison 1

- car insurance quotes florida 1

- car insurance ratings 1

- car insurance reviews 2

- carb ratio 1

- Care 1

- carriers 1

- Casseroles 6

- Cassidy 5

- Cassidy-Collins 1

- CBO 1

- CDE 1

- CDHP 1

- CDI 1

- Cedars-Sinai 1

- celebrities 1

- celebrity 1

- Centene 1

- certification 2

- certification number 1

- cgm 3

- cgms 2

- Chanel 2

- change 5

- changes 3

- Charlie Kimball 1

- cheap 1

- cheap auto insurance 1

- cheap auto insurance quotes 2

- cheap auto insurance quotes online 1

- cheap california auto insurance 1

- cheap car insurance 1

- cheap car insurance florida 1

- cheap car insurance quote 1

- cheap car insurance quotes 3

- cheap online car insurance quote 1

- cheap temporary car insurance 1

- cheaper 3

- cheapest auto insurance 1

- cheapest auto insurance rates 1

- cheapest car insurance in florida 1

- cheapest car insurance quote 1

- cheapest car insurance quotes 1

- Cheese 5

- Cheesecakes 10

- Chickens 13

- children 1

- Children with Diabetes 2

- Chili 6

- Chinese community 1

- CHIP 2

- Chocolates 18

- choices 2

- Chowder 2

- Christian louboutin 1

- Cigna 4

- claims 1

- Closed 1

- Closing 2

- CMS 3

- Colgate 1

- collapse 1

- collector car insurance 1

- combinable 1

- commentary 1

- commercial auto insurance 1

- commercial auto insurance companies 1

- commercial auto insurance quote 1

- commercial auto insurance quotes 1

- committee 1

- community 2

- compare auto insurance 1

- compare auto insurance prices 1

- compare auto insurance quotes 1

- compare auto insurance quotes online 1

- compare auto insurance rates 2

- compare car insurance quote 1

- compare insurance rates 1

- complications 1

- concepts 1

- concierge medicine 1

- Congress 9

- Congressional Budget Office 1

- contract 3

- cookabetes 5

- Cookies 16

- corrected 1

- correction 1

- Cortisone 1

- cost 1

- Cost Share Reduction 5

- costly 2

- costs 2

- County 1

- Coverage 6

- Covered CA 20

- Covered California 30

- Credit 1

- Crock Pot 3

- CSR 4

- CT 1

- Cupcake & Muffins 19

- Curry 1

- customer 1

- cuts 2

- CVS 1

- CWD 3

- CWDFFL 3

- cyber 2

- data 2

- Dave Fluker 1

- Dave Jones 6

- David Fluker 1

- dblogweek 1

- DC 2

- deadline 2

- Dear Diabetes 3

- death spiral 1

- death's door 1

- debbie 2

- delayed 1

- denied 2

- department 1

- department managed healthcare 1

- Department of Insurance 2

- depression 2

- Desserts 81

- destroy 1

- destruction 1

- Diabetes 129

- diabetes #ndam 1

- diabetes advocacy 1

- diabetes and stress 3

- diabetes and the dentist 1

- Diabetes Bitch Switch 1

- diabetes blog week 2

- diabetes brain 5

- diabetes burnout 4

- diabetes choices 1

- Diabetes Dark Ages 2

- Diabetes Fashion Files 1

- diabetes free write 1

- diabetes guilt 2

- diabetes history 1

- diabetes humor 8

- diabetes MacGyver 2

- Diabetes Media Muck-ups 3

- Diabetes Mysteries 1

- Diabetes On-line Community 1

- diabetes online community 3

- diabetes pac 1

- diabetes peer support 1

- diabetes police 1

- Diabetes Positives 1

- diabetes supplies 3

- Diabetes Technology 2

- diabetes training camp 1

- diabetes weirdness 1

- DiabetesMine Innovation Summit 1

- Diaversary 4

- direct car insurance 2

- Direct Primary Care 1

- discontinuation 4

- discount 4

- discount auto insurance 1

- discount auto insurance quotes 1

- disintegration 1

- District Court 1

- DMHC 1

- DOC 28

- doctors 3

- documents 1

- DOI 3

- Donald Trump 33

- done 1

- DPC 1

- dQ&A 1

- Dr. Molina 1

- draft forms 1

- drop coverage 1

- drug store 1

- drugs 1

- dsma 3

- elect 1

- elephant auto insurance reviews 1

- elephant car insurance 1

- elephant car insurance reviews 1

- eligible 1

- eliminated 2

- emotions and diabetes 1

- empathy 1

- Employee 1

- employees 1

- employer 2

- empowered 1

- Enchiladas 2

- Endo 1

- enhanced silver 4

- EnhancedCare 1

- enhancement 1

- enrollees 1

- Enrollers 1

- Enrollment 3

- EPO 2

- erroneous 2

- error 2

- estimate 2

- evidence 1

- exchange 11

- exclusion 1

- executive order 1

- exercise 3

- exit 1

- exiting 3

- expansion 1

- expensive 3

- extended 9

- extension 9

- extra time 1

- EZpay 1

- failed 1

- failure 2

- Family Health 9

- famous 1

- fashion 3

- fashion blog 1

- fashion week 1

- federal 1

- federal court 1

- federal exchange 1

- Federal Poverty Level 1

- feedspot 1

- FFM 1

- fine 2

- fines 1

- Fired 1

- first year 1

- fitness 1

- five 1

- fix 1

- floor vote 2

- Fluker 1

- for profit 1

- Foundation 1

- free auto insurance quote 1

- free auto insurance quotes 2

- free car insurance quotes 2

- free online car insurance quotes 1

- freedom 1

- freedom blue 1

- funding 1

- G 1

- Gen-Y 1

- general auto insurance reviews 1

- generation Y 1

- GeoBlue 1

- get checked out 1

- giveaway 2

- glucose meters 3

- go auto car insurance 1

- go auto insurance 1

- good to go auto insurance 1

- google 1

- GOP 14

- government 4

- Governor 1

- grace period 1

- Graham 4

- Graham-Cassidy 3

- grandfathered 3

- grievances 1

- group 2

- group health insurance 1

- grundy classic car insurance 1

- Hackers 2

- havoc 1

- HBEX 4

- HC 1

- HCC 3

- HCP 1

- HDHP 1

- health benefits exchange 3

- health bill 1

- health care 1

- health exchange 4

- Health Insurance 53

- health insurance. 10

- Health Net 8

- Health Plan 1

- health plans 3

- health reform 19

- Health Savings Account 1

- health sherpa 1

- healthcare 11

- Healthcare reform 13

- healthiest 1

- healthNet 1

- HealthSherpa 1

- Healthways 1

- Healthy California Act 4

- hearing 1

- help 2

- HHS 4

- High Deductible 1

- high risk 1

- highest 1

- HIPAA 1

- HMO 2

- Holidays 9

- Hope Warshaw 1

- Hospital 1

- hospitals 1

- hostile 1

- house 9

- household savings 1

- how much car insurance 1

- how much is car insurance 2

- how much is car insurance for a 16 year old 1

- how much is car insurance for a 18 year old 1

- HSA 3

- HSP 1

- HTH Worldwide 1

- Humana 3

- id 1

- ID Cards 1

- id theft 1

- Idaho 3

- IdahoCare 1

- identity theft 1

- IFP 5

- illegal 4

- immigrants 2

- In-Network 3

- Included 1

- individual 3

- Individual Health 38

- infrastructure 1

- infusion set 4

- Infusion set humor 1

- infusion site 5

- injuries 1

- Innovative F 1

- Innovative Plan F 1

- instagram #dsma 1

- instant car insurance quote 1

- instant quote 1

- insulet 1

- insulin 18

- insulin pump 27

- insulin pumps 2

- insulin reservoir 2

- insurance 9

- insurance auto auction 1

- insurance auto auction florida 1

- insurance auto auction inc 1

- insurance rates 1

- insurance ratings 1

- insureblog 1

- Interactive 2

- interim 2

- Internal Diabetes Bullshit filter 1

- international 1

- investigation 1

- Iowa 1

- IRS 5

- it girl 1

- J.Mario Molina 1

- Jan 15th 1

- January 15 2

- January 19 1

- January 31 2

- jdrf 3

- Jerry Brown 4

- Jimmy Kimmel 1

- John Hancock Vitality Program 1

- John McCain 1

- join 1

- Jones 2

- judy reich 1

- June 1

- Justice Department 1

- Kaiser 4

- Kaiser Family Foundation 1

- keep 1

- kicked off 1

- kidlets 1

- Kimmel 1

- LA Times 2

- labs 1

- LADA/type1.5 100

- language 2

- Lara 10

- Lasagna 3

- late mailing 1

- lauren's hope 1

- lawsuit 2

- leather 1

- leaving 4

- legislation 2

- letters 1

- Letters To Diabetes 3

- license 1

- lie 1

- life 3

- life for a child 1

- lilly diabetes 1

- limit 3

- Lindsey Graham 1

- list 2

- list of auto insurance companies 1

- Lite 1

- little ripples 1

- live 1

- living with diabetes 5

- log in 1

- Los Angeles 1

- Lose Medicare 1

- losing 2

- loss 2

- louboutin 2

- low 1

- low cost 1

- low cost auto insurance 1

- low cost auto insurance california 1

- low cost auto insurance in california 1

- low cost auto insurance quotes 1

- Low Income 4

- low premium 2

- lower 1

- Lows 5

- lujan 2

- lying 1

- mailing 1

- Main Dishes 7

- major risk 1

- mandate 1

- manged 1

- Map 3

- MAPD 1

- mapper 1

- March 1 1

- march 2014 1

- march 2017 1

- Market 1

- Market Stabilization 1

- marketplace 4

- markup 1

- May 2015 1

- maybe 1

- McCain 1

- Meatballs 1

- Medi-Cal 6

- Medi-Gap 4

- Medicaid 6

- Medical 1

- medical care 1

- Medicare 12

- Medicare Advantage 1

- Medicare Supplement 6

- Medigap 4

- Medtronic 1

- member 1

- membership 1

- merger 4

- metforminER 2

- Mexico 1

- michael lujan 1

- middle class 2

- millennial 1

- millennials 1

- minute clinic 1

- mistake 1

- Mo Brooks 1

- molina 2

- molina healthcare 1

- Molyneux 1

- money 1

- More Than My Diabetes 1

- more time to enroll 1

- MRMIB 1

- MRMIP 1

- MSP 1

- MSPP 1

- Multi State 1

- Multi State Plan 1

- Mushroom 1

- music 1

- My Sister 1

- NASHP 1

- national average 1

- navigators 1

- net neutrality 1

- Network 4

- networks 3

- neutrals 1

- new 2

- new benefit 1

- new business 1

- new contract 1

- new plans 2

- New to Medicare 4

- New York Post 1

- no carriers 1

- No diabetes 1

- no extension 1

- No HSA 1

- no mailing 1

- no subsidy 3

- No Vote 2

- non-compliant 2

- non-grandfathered 6

- not accepting 1

- not eligible 1

- not for profit 1

- notification 2

- NY Post 1

- Obama 3

- obamacare 81

- ObamaCare Lite 6

- off exchange 5

- omnipod 7

- on-exchange 1

- one day car insurance 1

- one month 1

- one-time 1

- online auto insurance quotes 2

- online car insurance quotes 1

- open enrollment 6

- operator 1

- OPM 1

- Oreo 1

- Oscar 1

- Oscar Health 1

- ousted 1

- out of business 3

- out of network 1

- out of state 1

- Palo Alto Medical Foundation 1

- PAMF 1

- panel 1

- Paris 4

- Paris fashion week 1

- paris girl 1

- paris street style 2

- Paris style 1

- participants 1

- pass 2

- Passed Senate 1

- Pasta 7

- patient 1

- patients 1

- Paul Ryan 10

- pay 1

- payer 1

- Payment 2

- pdf 1

- penalty 1

- personal information 1

- Peter Lee 2

- pharma 1

- Pie 2

- Plan 1

- Plan A 1

- Plan F 2

- Plan G 1

- Plan N 1

- podding 2

- poll 1

- Potatoes 4

- potus 1

- PPACA 7

- PPO 4

- pre-existing conditions 3

- prediabetes 1

- Premera 1

- premium 10

- premium credit 1

- premium increase 5

- premium payment 1

- premium tax credit 1

- prescriptions 2

- president 2

- Price 2

- priority 1

- private 1

- private market 5

- profile 1

- progressive 1

- proposal 1

- providers 2

- public 1

- pulls out 1

- pump supplies 2

- purchase 2

- QLE 1

- qualifying life event 1

- quality 1

- quote 1

- quotes 1

- quoting 1

- Rand Paul 2

- rank 1

- Rate Change 3

- rate decrease 1

- Rate Increase 5

- rate review 1

- rates 2

- rating area 3

- re-reform 1

- READTHEBILL 1

- recognition 1

- reconciliation 1

- reduce cost 1

- reduced contribution 1

- reduced participation 1

- reduction 1

- reform 2

- Refund 1

- regulator 1

- remain grandfathered 1

- remove 1

- remove SSN 1

- removed 1

- Rendon 1

- renewable 1

- repair 1

- repeal 9

- repeal and replace 6

- replace 9

- replacement 2

- reprieve 1

- republican 3

- resigns 1

- review 1

- revisions 1

- revocation 1

- reward 1

- Right Angle 3

- RIP Kitty 1

- risk 1

- risk pool 2

- rob paravonian 1

- robrocks 1

- Ron Pollack 1

- rules 2

- rump 1

- run 1

- Ryan 1

- RyanCare 7

- Sacramento 1

- Salad 1

- sales 3

- Sandwich 1

- Santa Cruz 1

- Sauce 1

- save 1

- savings 5

- SB 10 3

- SB 562 7

- scar tissue 1

- schoolhouse rock 1

- Scott Norwood 1

- Scott Ott 3

- search 1

- second lowest cost 2

- secret 1

- Security 2

- select 1

- selling 1

- Senate 5

- senate bill 1

- senators 5

- seniors 4

- SEP 3

- Settlement 1

- sex and diabetes 1

- Sharp 1

- sherpa 1

- SHOP 1

- SHOP exchange 2

- short term health insurance 2

- short-term 5

- Side Dishes 1

- Silver 6

- silver sneakers 2

- single 2

- single payer 7

- Single with diabetes 1

- skimpy 1

- skin 1

- Slow Cooker 2

- small employer 3

- Small Group 9

- social media 3

- social security number 1

- Sofia Champalanne 5

- sold 1

- Solicitation 1

- song 1

- Soup 23

- Southern California 1

- sparearose 3

- special election period 2

- special enrollment period 3

- spring 2

- spring 2014 1

- SSN 1

- stanford 1

- stanford health care 1

- stars 1

- startup 1

- state 1

- state lines 1

- Stefan Molyneux 1

- Steven Green 3

- Stews 6

- STM 2

- stop 1

- street style 4

- street style blog 1

- streetstyle 1

- stress 2

- stripped down 1

- Stupid People Tricks 1

- style 4

- style blog 4

- styled 1

- subscriber number 1

- subscription 1

- subsidies 6

- Subsidy 7

- summer 1

- super secret 1

- supplement 3

- support 3

- surcharge 1

- surgery 1

- surprise 1

- suspending 1

- suspension 1

- Sutter 2

- Sutter Health 2

- t1Everydaymagic 1

- takeover 2

- tax 3

- tax credit 4

- tax exclusion 1

- tax exempt status 1

- tax forms 2

- tax penalty 1

- tax reform 2

- taxes 2

- technology 1

- temp basals 1

- temporary 1

- temporary car insurance 1

- temporary car insurance california 1

- temporary car insurance cover 1

- Tennessee 1

- termination 2

- termporary 1

- teststrips 5

- THANK-YOU 2

- the cost of diabetes 7

- The Daraprim Effect 1

- The Diabetes UnConference 1

- Things That Make Me Go Hmmmm 1

- Tokio Marine 3

- Tom Price 1

- top 10 auto insurance companies 1

- Top 30 1

- top priority 1

- topics 1

- traditional 1

- transparency 2

- travel 1

- Traveling with Diabetes 5

- Trifles 1

- trigger finger 1

- Trump 41

- TrumpCare 55

- truthful 1

- tsa 1

- tubing 1

- turning 65 2

- twitter 1

- two party 1

- type 1 diabetes 110

- type 1.5 2

- type 2 102

- type 3 3

- TypeOneNation 2

- UFCW 1

- unaffordable 1

- under 19 1

- under 50 1

- underwriting 1

- undocumented 2

- United Healthcare 1

- United healthcare#diabetesaccessmatters 1

- universal 1

- universal healthcare 1

- universal heatlhcare 3

- unprepared 1

- Valley Health Plan 1

- Ventura 1

- verification 1

- VHP 1

- video 2

- views 1

- Village Doctor 1

- vimeo 1

- vintage 1

- vision 1

- Vox 1

- Vox.com 1

- waiver 1

- Washington 2

- wdd 2

- weight 2

- Wellmark 1

- Wells Fargo 1

- Western health advantage 1

- when it doubt 1

- whistleblower 1

- Withdrawn 4

- Women With Diabetes And Now Children 1

- Woodside 1

- worked 1

- working out 2

- world diabetes day 1

- Year Round 1

- your voice matters - use it! 1

- youtube 2

- Zara 1

- zombie infusion site 1

Menu Footer Widget

Crafted with by Salik Moeen | Copyright @ 2019 Worldz of Technology

0 Comments